This blog is fully dedicated for Indian share traders. This blog could help you view World market watch, BSE/NSE Spots in single page.

Bidvertiser

Inflation at 6.84%

The sharp drop was triggered largely by the drop in petrol and diesel prices, analysts said.

The inflation rate was 3.84 per cent during the corresponding week last year.

The official wholesale price index (WPI) for all commodities during the week declined by 1.1 per cent to 231.1 points from 233.6 points the week before.

Data on wholesale prices released by the commerce and industry ministry showed that the index for primary articles declined 0.4 per cent to 249 points, from 249.9 points the previous week.

The index for food articles declined by 0.5 per cent while that of non-food articles rose marginally to 234.6 points (provisional) from 234.4 points (provisional) during the week under review.

The index for fuels and lubricants also declined by 3.7 percent to 332.1 points (provisional) from 345 (provisional) the previous week.

The index for the manufacturing sector declined by 0.3 percent to 202.4 points (provisional) from 203.1 (provisional) for the previous week.

Courtesy: hindu.com

Cheers for Sensex - Close over 10000 mark

Wholesale price index rose 6.84 per cent in the 12 months to Dec 6, below the previous week's annual rise of 8 per cent. It was below a median forecast of 7.49 per cent in a poll of analysts.

At 2pm, Bombay Stock Exchange’s Sensex was at 10,009, up 293.95 points or 3.03 per cent. The index touched an intra-day high of 10,015.58 and a low of 9633.04.

National Stock Exchange’s Nifty was at 3032.25, up 2.64 per cent or 77.90 points. The 50-share index hit an intra-day high of 3040.30 and a low of 2922.65.

BSE Midcap Index was up 1.39 per cent and BSE Smallcap Index moved 0.43 per cent up.

All the sectoral indices were in the green. BSE Realty Index was up 5.31 per cent, BSE Bankex moved 5.08 per cent higher and BSE Power Index jumped 4.08 per cent.

Satyam Computer Services (7.21%), DLF (6.20%), ACC (5.90%), State Bank Of India (5.89%) and ICICI Bank (5.87%) were the top Sensex gainers.

Sterlite Industries (-2.23%), Tata Steel (-2.10%), Hindalco Industries (-1.93%) and ONGC (-0.08%) were amongst the major Sensex losers.

Market breadth was positive on the BSE with 1288 advances and 1021 declines.

Courtesy: economictimes.indiatimes.com

Sensex ends down 262 points, Satyam close at 4–year low

The 30-share benchmark index opened higher on Wednesday at 10,073.10, tracking overnight Wall Street gains but after witnessing choppy trade during morning session, tumbled to the day's low of 9682.91 on profit taking even as Indian tech major Satyam Computer Services plummeted to a 4-year low on sudden news that it had abandoned a deal for two firms, sparking concerns abroad over corporate governance.

After Wednesday's decline, the market barometer is down about 50.8 percent, making it one of the worst performing markets in Asia.

Twenty-one components closed in the red, the biggest loser being Satyam Computer Services, which plunged 30.22 percent to a 4-year low of Rs.158.05 on overnight news that founder-chairman B. Ramalinga Raju had intended to use company funds to buy two of his firms floated by him and his sons for $1.6 billion. Satyam abandoned the deal after its shares were hammered down 55 percent in Nasdaq overnight but it was too late to stop its decline in the Indian market.

Private sector utility majors Reliance Infrastructure and Tata Power tumbled 13.73 percent and 5.92 percent to Rs.549.15 and Rs.702.95 respectively.

Telecoms majors Reliance Communications and Bharti Airtel declined 13.36 percent and 4.73 percent to Rs.202.70 and Rs.709.65.

Real estate giant DLF slipped 8.64 percent to Rs.253.20.

Sensex heavyweight top listed Reliance Industries eased 2.64 percent to Rs.1350.15.

Other major losers were Jaiprakash Associates (down 12.11 percent at Rs.76.95), ACC (down 9.21 percent at Rs.486.30) and Sterlite Industries (down 5.16 percent at Rs.271.20).

The day's top gainer was ICICI Bank, which surged 2.43 percent to Rs.431.80. Smaller HDFC Bank climbed 1.83 percent to Rs.1002.05.

Tech majors Infosys Technologies and Wipro advanced 1.51 percent and 1.50 percent to Rs.1139.80 and Rs.243 respectively as investors moved to reallocate their portfolio of sector stocks.

Auto makers Mahindra & Mahindra and Maruti Suzuki rose 1.25 percent and 0.27 percent to Rs.303.95 and Rs.509.65 respectively.

Top consumer goods maker Hindustan Unilever soared 1.27 percent to Rs.251.25.

Other gainers were Grasim Industries (up .55 percent at Rs.1234.40) and ONGC (up 0.39 percent at Rs.716.50).

All the sectoral indices declined, the major losers being Realty (down 7.36 percent), TECk (down 5.02 percent), Power (down 4.44 percent), Metal (down 4.36 percent) and IT (down 4.04 percent).

The BSE Midcap and Smallcap indexes tumbled 3.33 percent and 2.60 percent to close at 3136.17 and 3678.56 respectively.

The overall market breadth was negative as 1569 losers outpaced 956 gainers while 72 closed unchanged.

Elsewhere, the broader 50-share S&P CNX Nifty index of the National Stock Exchange (NSE) closed 2.87 percent or 87.40 points down at 2954.35.

According to market traders, Indian shares lost steam midway, after rallying on overnight news that the US Federal Reserve has moved to slash its key interest rate to historic lows, and surrendered their gains with Satyam donning the villain's role of the day.

Wall Street gained overnight after the Fed cut its target rate for loans between banks to a range of 0-0.25 percent and pledged to use "all available tools" to heal the US economy.

All traders agreed that Satyam's decision reflected poorly on corporate governance in Indian companies and could dent their credibility and future earnings.

"There has been some healthy profit booking after two weeks of gains. But this was triggered by Satyam, which has raised a lot of corporate governance issues," said Amitabh Chakraborty, president (equities), Religare Securities.

"We woke up to the cancellation of acquisition deal between Satyam Computers and its subsidiaries. But investors felt cheated and the scrip took a beating," said Arun Mewawalla, AVP, Alternate Research, ULKJ Securities.

"By announcing such a deal, which was wiping off the entire cash in the balance sheet, the (Satyam) management has given a bad impression," Paras Bothra, research head, Ashika Stock Brokers, said.

"It's an overall hit for market sentiment. It reflects poorly on corporate governance in Indian companies, and it's an issue that investors are now faced with," said Nikunj Doshi, investment manager at Envision Capital.

"The global developments are baffling, and institutional investors continue to remain risk averse. The market (in India) has been showing some strength, of late, but I think a better strategy would be to keep putting money gradually," said Arun Kejriwal of KRIS.

However, traders are optimistic that the market may look up on Thursday as market players are expecting a rate cut from the central bank on the back of cooling inflation.

Meanwhile, global crude prices dropped $3 on Wednesday to their lowest levels in more than four years after OPEC announced a record supply cut that dealers said may fail to offset slumping world energy demand.

US crude oil prices fell $3.40 to $40.20 a barrel by 11:45 a.m. EST (1645 GMT), the lowest since July 2004, while London Brent fell 80 cents to $45.85 per barrel after the Organization of Petroleum Exporting Countries (OPEC), eager to push prices back up, announced on Wednesday an agreement to cut 2.2 million barrels per day of output starting January 1, the biggest single reduction on record.

Elsewhere in Asia, the markets closed in the green, boosted by overnight Wall Street gains and on hopes of revival of US auto bailout plan.

Japan's Nikkei 225 climbed 0.52 percent to 8612.52; Hong Kong's Hang Seng surged 2.18 percent to 15,460.52; China's Shanghai Composite moved up 0.09 percent to 1976.82; Taiwan's Taiex advanced 0.67 percent to 4648.02; and South Korea's Kospi soared 0.71 percent to 1169.75.

However, bucking the trend, Singapore's Straits Times eased 0.16 percent to 1779.29.

Courtesy: in.ibtimes.com

Satyam's promoters lose Rs. 597 crore in a day

The Maytas stock fell by 25% to Rs 388.25 on the BSE on Wednesday compared to its previous close of Rs 485.30 on Tuesday. On the other hand, the Satyam stock fell to its 52-week low on the BSE to Rs 158.05, a fall of 30% from its previous day’s close of Rs 226.50. Satyam chairman Ramalinga Raju had announced the deal after closing of the markets on Tuesday.

The ETIG analysis is based on the direct shareholding of the Raju family in Maytas and Satyam, as on September 30, 2008, which incidentally remains the same as of today. Promoters’ holding in Maytas Infra stands at 36.6% while it’s pegged at 8.6% in Satyam.

Interestingly, besides the 36.6% promoter holding in Maytas, some shareholders who appear to be related to the Raju family hold another 17% but do not figure among the promoters.

They include B Rama Raju, son of Satyam chief B Ramalinga Raju, who figures among both promoters and public shareholders. He holds 8.74% as part of public shareholding, besides being part of promoters with a shareholding of 2.52% in Maytas Infra.

If we include the holding of these three large shareholders, B Rama Raju, Radha Raju Byraju and B Suryanarayana Raju, with the promoters stake, the Rajus have lost another Rs 100 crore as part of their shareholding in Maytas Infra. This takes their total erosion in wealth to around Rs 700 crore($140 million).

Meanwhile, on Tuesday, Satyam ADR closed at $5.7, registering a fall of 55% on Nasdaq, post announcement of the buyout. The ADR has, however, recovered to $8.05, post the company calling off the deal.

Interestingly, the Maytas Infrastructure stock has been trading in the range of Rs 355–518, in the past six months. On the other hand, other infrastructure stocks like IVRCL Infra, Gammon, Nagarjuna, HCC, have crashed up to almost 80% in the same period.

Courtesy: economictimes.indiatimes.com

Brokers want Government to suspend STT to boost Markets

"The government should at least suspend securities transaction tax for a year. This will encourage market participants to take their position aggressively. The sentiment of the market will improve as the volume will increase," Bonanza Portfolio President Research P K Agarwal said.

The STT, levied on share transactions at 0.125 per cent of the total value, declined to Rs 4,156 crore during April-November 2008, down 15.42 per cent during the corresponding period last year, mainly on account of reduced capitalisation in the India securities market.

Indian stock markets have suffered immensely on account of withdrawal of funds by the Foreign Institutional Investors (FIIs) with Bombay Stock Exchange benchmark Sensex declining from a high of over 21,000 to less than 8,000 points.

The turmoil in the market had an adverse impact on the turnover from the national stock exchange. It reduced to Rs 1,73,123 crore in November from Rs 4,47,138 crore in January, when the market was at its peak.

The total equity turnover from the Bombay Stock Exchange also declined to Rs 63,571.11 crore in November from Rs 1,85,622.78 crore in January.

"Removal of securities transaction tax will be a very good option but even if the government goes back to the earlier position (when it was used for tax deduction rather than as expense at the current level), it will be a big boost to the market," SMC Global Securities VP and head research Rajesh Jain said.

Courtesy: business-standard.com

Indian Rupee Strong on Fed rate cut hope

The U.S. Federal Reserve is widely expected to cut its key rate by 50 basis points to 0.5. One-month offshore Non-Deliverable Forward contracts were quoting at 48.07/22 per dollar, weaker than the onshore spot rate, indicating a bearish near-term outlook for the rupee.

Indian stock markets opened slightly higher and closed around 1.2% higher. Strength seen in stock markets coupled with lower oil prices could support rupee in the near term. Strength seen in stock markets could see some fresh foreign capital inflows in coming days. FII’s have been net buyers of about $380 million shares in December. Oil prices around $45 could see larger supply cut by OPEC at Dec 17 meeting.

Indian stock markets opened slightly higher and closed around 1.2% higher. Strength seen in stock markets coupled with lower oil prices could support rupee in the near term. Strength seen in stock markets could see some fresh foreign capital inflows in coming days. FII’s have been net buyers of about $380 million shares in December. Oil prices around $45 could see larger supply cut by OPEC at Dec 17 meeting.Crude oil dropped 4% yesterday on persistent worries of a deepening slump.Dollar weakness across the currency basket on expectation that US Federal Reserve will cut interest rate to near zero saw support being provided to rupee.

Fed rate cut would be a positive sign for rupee and it could prompt a further upside. Key interest rates in the country could continue to ease in the coming time, due to the softening of inflation, resulting in the possibility

of more credit injection to the economy.

MCX-SX INR December’08 futures prices closed stronger towards 47.99. MCX-SX INR December’08 futures moved in a range of 48.30 and 47.892 during the day. Supports are at 47.50/47.40 followed by 47.10/47. Resistances are at 48.20/48.30 followed by an important 48.90/49 range. MCX –SX futures registered a volume of 877.74cr all contracts put together.

MCX-SX INR January’09 futures closed towards 48.14 and registered a decrease in volume by 26.38%. The MCX-SX INR January’09 futures printed an open interest of 17601.

Spot rupee immediate Supports are at 47.4/47.50 levels being a rising channel support followed by 46.70/46.80 Resistance is at 48/48.10 followed by crucial resistance at 48.50/48.60.

MCX-SX INR futures active December contract registered volume decrease of around 9.60% over the previous session.

Courtesy: commodityonline.com

Sensex tests 10000 mark

MUMBAI: The Indian stock market rallied across the board Tuesday outperforming global markets yet another day. Indices opened on a dull note tracking lacklustre Asian markets while second rung stocks maintained upward march as advance tax numbers trickled in. However, in the last one hour of trade frontline stocks gained momentum led by Reliance Industries and ONGC.

MUMBAI: The Indian stock market rallied across the board Tuesday outperforming global markets yet another day. Indices opened on a dull note tracking lacklustre Asian markets while second rung stocks maintained upward march as advance tax numbers trickled in. However, in the last one hour of trade frontline stocks gained momentum led by Reliance Industries and ONGC.“Indian oil companies were left behind when shares of global oil companies were moving higher. So they are just playing a catch up game,” said Deepak Sawhney, research head, Networth Stock Broking.

This rally helped the indices to cross psychological levels. Bombay Stock Exchange’s Sensex ended at 9,976.98, up 144.59 points or 1.47 per cent. The index managed to cross the crucial 10,000 level in intra-day trade. It zoomed to a high of 10,009.21 from a low of 9,790.31.

National Stock Exchange’s Nifty managed to close above the psychological level of 3000. It ended 2.03 per cent or 60.55 points higher at 3,041.75. The broader index hit a high of 3052.55 and a low of 2963.30.

“Since the beginning of this month Sensex has been outperforming the world markets while discounting bad news. We seem to be close to the end of last leg of recent pull-back rally. If the world market tilts towards negative, Indian market is likely to outperform on the downside as well,” added Sawhney.

Secondline stocks continued their run for a third consecutive day, outperforming bluechips. BSE Midcap Index closed 2.50 per cent up and BSE Smallcap Index ended 3.21 per cent higher.

“Midcaps were beaten down too much. With the rally in the frontline getting narrower, investors with cash were cherry picking in B-group companies which are expected to report better than expected quarterly results,” he said.

Significant gains in ONGC (6.07%), Grasim Industries (4.59%), ACC (4.34%), Tata Motors (4.33%), HDFC Bank (4.1%), and NTPC (3.5%) propped up the Sensex.

Losers comprised Sterlite Industries (-7.07%), HDFC (-4.13%), Reliance Infrastructure (-2.53%), Reliance Communications (-2.11%), and Larsen & Toubro (-1.23%).

There was some stock specific action also. Reliance Infrastructure and Reliance Natural Resources fell after reports that these two Anil Ambani owned companies were involved in fraudulent banking activities overseas. Shares of RNRL ended 2.21 per cent lower and Reliance Infrastructure slipped 2.97 per cent.

HCL Technologies rose after the firm said it has signed over $1 billion in contracts during Oct-Dec. This is the highest ever in a single quarter, helped by its purchase of British software firm Axon. HCL, on Monday, completed the largest overseas buy by an Indian IT firm spending 441 million pounds for Axon, topping a bid by larger rival Infosys Technologies. The HCL Tech scrip surged 18.49 per cent.

Suzlon Energy has revised the payment schedule agreed upon by the company and the Martifer Group of Portugal for Martifer's 22.4 percent stake in REpower Systems AG, Germany. As per the new terms, Suzlon will pay Martifer around Euro 65 million in December 2008, Euro 30 million in April 2009 and final tranche of Euro 175 million in May 2009. Upon completion of this transaction, Suzlon will reach ownership level of 91 per cent in REpower. The stock advanced 6.52 per cent.

Shares of airline companies were in demand on reports of a further 11 per cent cut in ATF prices after a steep decline in international crude oil prices. Kingfisher Airlines closed 5.41 per cent up and Jet Airways ended 3.95 per cent higher.

Market breadth on BSE remained extremely strong with 1,866 advances against 648 declines.

European markets bounced back on expectations of a rate cut by the US Federal Reserve. US markets were likely to open higher ahead of the FOMC meet. Dow Jones futures were up 0.68 per cent, S&P 500 futures moved 0.86 per cent higher and Nasdaq futures gained 1 per cent.

Courtesy: economictimes.indiatimes.com

Sensex ends 100 points down at 8739

Bombay Stock Exchange’s Sensex ended at 8716.42, down 123.45 points or 1.40 per cent. The index touched an intra-day high of 8745.23 and a low of 8467.43.

National Stock Exchange’s Nifty closed at 2662, down 0.78 per cent or 20.90 points. The 50-share index hit an intra-day high of 2672.90 and a low of 2570.70.

BSE Midcap Index was down 1.67 per cent and BSE Smallcap Index fell 1.54 per cent.

Amongst the sectoral indices, BSE FMCG Index closed 0.80 per cent, BSE Realty Index was up 0.41 per cent, BSE Power Index ended 0.13 per cent up.

BSE Auto Index ended 2.81 per cent lower, BSE IT Index slipped 2.51 per cent and BSE Oil & gas Index fell 2.51 per cent.

Gains in Reliance Infrastructure (5.6%), Bharti Airtel (3.2%), Jaiprakash Associates (2.93%), NTPC (2.66%), DLF (2.24%) and ITC (2.24%) helped indices close off lows.

Mahindra & Mahindra (-8.1%), Maruti Suzuki (-5.26%), Tata Consultancy Services (-4.9%), Larsen & Toubro (-3.28%) and Tata Steel (-3.16%) ended with significant losses.

Market breadth on BSE remained weak with 1283 declines outnumbering 796 advances.

(All the figures are provisional)

Courtesy: economictimes.indiatimes.com

Indian Rupee closes at record low of 50.29/$

The currency extended a three-week decline after India’s deadliest terrorist attacks in 15 years that lasted almost for four days.

The currency extended a three-week decline after India’s deadliest terrorist attacks in 15 years that lasted almost for four days.

Rupee closed at a record low as a slide in equities fueled concern investors will increase sales of local shares. The currency extended a three-week decline after India’s deadliest terrorist attacks in 15 years that lasted almost for four days.

Sensex slid 2.8% today, taking this year’s loss to 56.4%. The rupee dropped 0.4% to close at 50.29 per dollar, according to the reports. It fell as low as 50.355 in intraday trading.

FIIs sold Indian equities worth a record US$13.7bn more than they bought this year, according to the SEBI data.

Courtesy: indiainfoline.com

Indian economy grows by 7.6% in Q2, FM terms it satisfactory

The economic growth, as measured by expansion in Gross Domestic Product (GDP), may be seen as slowing down as it clocked a 9.3 per cent a year ago, but it was much better than expected by many analysts, given the global financial meltdown.

"This is a satisfactory and healthy growth rate having regard to global slowdown," Finance Minister P Chidambaram told reporters.

For the second half, the economy registered a 7.8 per cent growth rate, compared with 9.3 per cent a year ago, much in line with official projections for 7-8 per cent for the fiscal.

However, analysts said services, which came to the aid of the economy, are expected to slow down in the coming quarters and the Reserve Bank (RBI) and the government must come out with some stimulating measures to perk up the economy.

"Going forward the services sector is likely to slow down, particularly the hotel construction and transport," Crisil Principal Economist D K Joshi said.

Moody's economy.Com said the government and the RBI should come out with stimulating measures to induce growth.

While construction sector grew by 9.7 per cent in the second quarter from 11.8 per cent a year ago, services sectors displayed similar pattern of high growth, though slightly slower than last year.

However, manufacturing grew by just five per cent in the second quarter from 9.2 per cent a year ago and halved to five per cent in the second half from robust 10.9 per cent.

Chidambaram admitted that manufacturing sector remains a problem area.PTI

Courtesy: ptinews.com

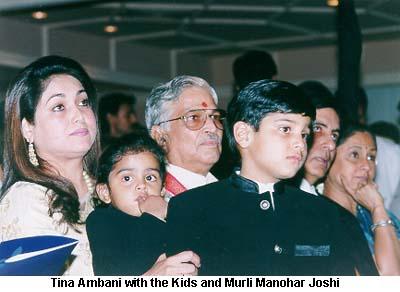

Tina Ambanias a part of the Mumbai marathon

| Tina's Team When family friend Tina Ambani organised a senior citizens’ marathon, as a part of the Mumbai marathon, the predictable cheerleader was Abhishek Bachchan. While husband Anil has become a mascot for the marathon, making sure he runs through the city everyday, Bachchan roped in his Bunty aur Babli costar Rani Mukherji, to flag off the event. The star presence drew the cameras—a perfect coup for Tina and her initiative. |  |

SEL Manufacturing receives contract from Russia

Under the proposed plan, the company is setting up a technical textile manufacturing facility with a capacity of 90 tonnes per day (TPD) envisaging Rs 611.67 crore. It is also expanding its terry towel project by 25 TPD, taking the terry towel capacity to 35 TPD after implementation. Sel is a 100 per cent export oriented garment producer.

It has appointed IL&FS, Kotak Mahindra Capital and SBI Caps to arrange targets from the domestic market. It is in talks with Citibank, Credit Suisse and Barclays to rope in an adviser for its overseas acquisition.

For the financial year 2007-08, the standalone net sales of the company was recorded at Rs 357.31 crore while the net profit stood at Rs 44.85 crore. Consolidated net sales was Rs 400.07 crore.

Courtesy: business-standard.com

Tesco enters Indian retail with Tata Trent

After wooing many Indian realty majors and retailers, including Bharti, the Wadias, DLF and Parsvnath, UK's largest retailer Tesco has decided to go solo by developing a cash-and-carry business with an investment of £ 60 million in the first two years.

After wooing many Indian realty majors and retailers, including Bharti, the Wadias, DLF and Parsvnath, UK's largest retailer Tesco has decided to go solo by developing a cash-and-carry business with an investment of £ 60 million in the first two years.It has simultaneously zeroed in on a tie-up with Trent, the Tata group retail arm, to develop the latter's discount hypermarket format.

The cash-and-carry business, also known as wholesale outlets, is the only retail format where 100% FDI is allowed. Tesco international & IT director Philip Clarke said, "We have made no secret of our wish to enter India and have had a team here for almost three years studying the market, talking to businesses and consumers and looking for the right way forward.''

While Tesco joins German rival Metro--the first to enter India in 2003--in opting for the wholly-owned cash-and-carry operations, Wal-Mart has a 50:50 JV with Bharti group and Carrefour is still exploring India.

The exclusive arrangement with Trent, for which Tesco will receive a fee, is one where the former can draw from the British chain's vast retail expertise and technical capability to support its own big box format Star Bazaar, which has been on a slow track, according to retail analysts. Launched in 2004, there are four Star Bazaar stores in the country.

Looking for sharper management focus and improvement in operations, Star Bazaar was recently transferred to a 100% Trent subsidiary, Trent Retail. "In large format retailing in India, hypermarket is the most challenging and eventually rewarding, as it has been abroad,'' said Trent MD Noel N Tata.

This (Star Bazaar transfer to Trent Retail) was done to beef up its large box format through local sourcing arrangements as against national sourcing.

This was done because as the latter was unviable, especially in food and groceries, due to infrastructure bottlenecks, tax inefficiencies and high freight costs. Another reason for hiving off Star Bazaar was that it could have tie-ups with international retailers to enhance its know-how.

Both these requirements will be fulfilled through Tesco association. Apart from accessing the $99.5-billion Tesco's marketing, stock management, retail information systems, cold-chain infrastructure and front-end services expertise, Trent will source merchandise for Star Bazaar from Tesco's wholesale outlets in India.

Tesco has 3,729 stores in 13 countries. Its first wholesale outlet will be set up in Mumbai shortly. However, unlike South African chain Shoprite, which has a brand franchise alliance with city-based realty firm Nirmal Lifestyle, the Tesco-Trent deal wouldn't see any Tesco branding at Star Bazaar outlets.

Trent's other retail formats are Westside (apparel and lifestyle), Landmark (books and music) and Sisley (manages the Italian apparel brand).

"From one store in 2004, we at present have four stores, which will be expanded further," Tata added.

Courtesy: timesofindia.indiatimes.com

Market will be volatile untill Aug 22

``With BSE, below the 15,150 level markets look weak upto 14,786 level, the latter being an important level for a bullish market. Also 39 new stocks having been introduced in the F&O is a healthy sign for the midcap stocks,`` said technical analyst, Vishwas Agarwal.

Agarwal further added, ``Coming holidays are also the reason for some profit booking. Overall view is still strong; market will be volatile until August 22 and will not give easy money.``

Courtesy: myiris.com

Latest IPO Grey Market Premium Rates as on 09-August-08

Grey Market Premium Rates as on 09-August-08

Company -> Open/Close -> Offer Price -> Premium

Resurgere Mines & Minerals Limited -> 11 August - 13 August -> 263 to 272 -> 17 to 18

Austral Coke And Projects Ltd -> 07 August - 13 August -> 164 to 196 -> 04 to 05

NuTek India Limited -> 29 July - 01 August -> 170 to 192 -> 06 to 07

Vishal Information Technologies Limited -> 21 July - 24 July -> 140 to 155 -> 03 to 04.50

Courtesy: greymarket.co.in

Resurgere Mines & Minerals India Ltd IPO Information

- Public Issue Open: Aug 11, 2008 to Aug 13, 2008

- Public Issue Type: 100% Book Built Issue (Initial Public Offer IPO)

- Public Issue Size: 44,50,000 Equity Shares of Rs. 10/-

- Face Value: Rs. 10/-

- Public Issue Price: Rs 263/- to Rs 272/-

- Market Lot: 20 Shares

- Minimum Order Quantity: 20 Shares

- Maximum Subscription Amount for Retail Investor: Rs 100,000/-

- Listing: BSE, NSE

- Lead Manager: Motilal Oswal Investments Advisors Pvt Ltd

- Registrar: Intime Spectrum Registry Ltd (Ph:

+91-22-25960320

+91-22-25960320 Email: rmmil.ipo@intimespectrum.com)

Email: rmmil.ipo@intimespectrum.com)

Vishal Information Technologies Ltd IPO Allotment Status - Click here

Vishal Information Tech Ltd IPO - Listing on Monday, August 11, 2008.

Bidding Status (IPO Subscription day by day)

No. of times issue is subscribed (BSE + NSE)

As on Date QIBs Non Institutional Retail (RIIs) Total

Day 1 - 21-Jul-2008 17:00:00 IST 0.0000 0.0000 0.0036 0.00

Day 2 - 22-Jul-2008 17:00:00 IST 0.0000 0.5795 0.0122 0.09

Day 3 - 23-Jul-2008 17:00:00 IST 0.0000 0.7340 0.2794 0.21

Day 4 - 24-Jul-2008 17:30:00 IST 0.4492 1.3584 2.1850 1.19

Courtesy: chittorgarh.com

'Rel Infra, Globalcom IPO only after markets stabilise' - Anil Ambani

“We have received the approvals on the Red Herring Prospectus… The volatility in global and Indian capital markets is what we are watching,” he said, adding that a decision would be taken at an appropriate time.

Replying to queries on the IPO of Reliance Infratel in India and listing of Globalcom in London, he told market analyst, “When we find an appropriate time, I am sure that we will proceed both with Globalcom and Reliance Infratel.

“We are using this time to complete the roll out on Infratel and also in our negotiations with our prospective customers for Globalcom”, he said in his post financial result conference.

Courtesy: greymarket.in

Mutual Fund industry down by 6% in July 2008

The combined average assets under management (AUM) of the 34 fund houses in the country dropped to Rs 5,29,629.46 crore in July, as compared to 5,64,752.76 crore in June, according to the data released by the Association of Mutual Funds in India (AMFI).

Analysts believe the bearish sentiments in the market and hardening of interest rates led to heavy redemptions last month leading to the sharp drop in average assets under management.

"The sharp drop in AUMs has been entirely due to heavy redemptions from investors during the month amid the volatility in the stock market...this shows investors are beginning to get impatient," mutual fund tracking firm Value Research Online CEO Dhirendra Kumar said.

Reliance MF registered the biggest drop of over Rs 6,200 crore in its average Assets under Management (AUM) in July.

However, despite a 6.88 per cent fall in its average AUM, Reliance Mutual Fund continues to be the top fund house in the country with assets valued at Rs 84,563.91 crore last month, against Rs 90,813.45 crore in the previous month.

"The stock market have been suffering in the month as the market value of investment is on the decline and the hardening of interest rates has made its difficult for banks and corporates to keep their surplus cash in income schemes, which led to withdrawal of funds from them," Taurus Mutual Fund Managing Director R K Gupta said. MORE PTI

ICICI Prudential, the second largest mutual fund, witnessed a loss of Rs 4,313 crore in its assets at Rs 55,160.66 crore in July, from Rs 59,473.58 crore in June.

HDFC Mutual Fund, which beat state-run UTI MF to notch the third slot in June, reported an average AUM of Rs 50,752.03 crore in July, down from last month's Rs 52,710.80 crore.

UTI Mutual Fund continued its fall in the average AUM, which was Rs 46,119.91 crore at the end of July, down 9.16 per cent from June's figure of Rs 50,770.57 crore.

Besides, AUM of Franklin Templeton MF stood at Rs 24,440.94 crore in July, against Rs 24,742.06 crore in the previous month.

Meanwhile, about eight fund houses managed to increase their assets under management in July which include -- ABN Amro MF, Benchmark MF, JP Morgan, Lotus India and Mirae Assets.

Courtesy: economictimes.indiatimes.com

Allied Blenders and Distillers plans for IPO

Allied Blenders’ and Distillers (ABD) Executive Vice-Chairman and Chief Executive Officer, Deepak Roy, told Business Line that a road map leading up to the IPO has been put in place. Once the balance sheet is cleaned up which should happen sometime this year itself, the company will raise a debt of around Rs 100 crore to acquire some distilleries. The IPO plans will be tied to the market conditions but the company expects to raise up to Rs 400 crore to fund its various expansion plans.

Greenfield projects

Roy, who owns about five per cent in ABD, said initially, around Rs 100 crore will be invested in acquiring four greenfield bottling plants and some bottling plants in Andhra Pradesh, Punjab and West Bengal which should reduce dependence on outsourcing. It also plans to set up its own primary distillery unit which will provide between 20 per cent and 25 per cent of spirits for its own use. Currently, the company uses about 25 bottling units for outsourcing its needs.

Roy said the company’s balance sheet was very weak and not adequately funded and carried a lot of debts. “We are going to clean up (the balance sheet) all that which will allow us to raise capital,” he said. The turnover of all ABD’s products is about Rs 800 crore and recorded a growth of about 49 per cent during the first quarter of this financial year. During the last three years, the company grew at a compounded rate of about 19 per cent.

New Launches

ABD also wants to reduce its dependence on a single brand, ‘Officer’s Choice,’ whish is considered the second largest brand in the prestige whisky segment in India. It is in the process of launching Germany’s leading vodka brand,

Wodka Gorbatschow in most markets and a few other brands during the next few years.

During FY08, ABD reported a growth of 30 per cent in sales of the brand to 6.6 million cases and a total sales of 6.86 million cases which grew at 22 per cent.

The IMFL industry grew at about 22 per cent.

The company has projected sales of 8.5 million cases during this fiscal.

MCX postpone its IPO

MCX had filed the Draft Red Herring Prospectus (DRHP) for the IPO in February. This was for the first time that a commodity exchange filed application with the market regulator, Securities & Exchange Board of India (SEBI) for an IPO that planned to raise Rs 500 crore to Rs 600 crore.

But top MCX officials said on Sunday that the IPO plans have been shelved for the time being. MCX Managing Director and CEO Joseph Massey said that the exchange has decided to postpone the IPO “taking into consideration the market scenario and the advice of the merchant bankers to defer the issue.”

The main reasons that has compelled MCX defer the IPO are the falling stock market, rising interest rates and the possibility that the government may introduce the commodities turnover tax on commodity exchanges.

Finance Minister P Chidambaram has proposed in the Budget a tax of 0.017% on the seller of a commodity contract and 0.125% on the buyer. Besides, a service tax of 12% on the exchange levy and an education cess on the tax are also planned.

Commodity exchanges, brokers and the apex Forward Markets Commission have opposed the commodities transaction tax (CTT) saying it would adversely affect futures trading in commodities.

MCX, promoted by Financial Technologies India Limited, is India’s biggest commodity exchange for the trading of precious metals, ferrous and non-ferrous metals, energy agriculture and industrial commodities.

Founded in 2003, MCX has exhibited strong leadership in product innovation, trading and clearing functionality, self-regulation, transaction cost efficiency and customer focus, positioning MCX to compete on a global scale.

Courtesy: greymarket.in

Growth stocks: Riddhi Siddhi Gluco Biols

Starch and Sweetners manufacturer Riddhi Siddhi Gluco Biols is set to announce outstanding results in the June quarter. This agroprocessing company’s underperformance is mainly due to fire in Gokak plan which disrupted its business for 6 months. Both Uttarakhand and Gokak (Karnataka) plants are now operating and company is expected to post turnaround results in the coming quarters. Company bought Bio-polymers business from Hindustan Unilever and this midcap corn-wet-miller company is planning to use this Pondicherry unit as a research hub.

Riddhi Siddhi Gluco stock price analysis:

CMP: 188.25

P/E: 10.6

Book value: 123

1 year high-low: 309-166

Riddhi Siddhi stock target price:

1 year target: 350-380. One will surely get more than 80% returns in 1 year. EPS for FY09 will be around 35-40.

Why Riddhi Siddhi Gluco is a “must buy”?

1. EPS is expected to increase from 18 to 40 by conservative estimates.

2. Sales are expected to grow by 70% and profit may rise by 120%, according to analysts.

3. Agro-processing has huge prospects.

4. Government will promote agriprocessing business aggressively in the next budget.

5. Aggressive expansion plans will help the company in the next 2 years to post good results.

Verdict: Riddhi Siddhi Gluco Biols is a very good stock for accumulation to get more than 80% annual returns. Accumulate this stock without hesitation on any fall for long term investment. This midcap company set to outperform the market in the next 12 months.

Stock rumor: Sony Ericsson may acquire Spice mobile

According to Economic Times, Sony Ericsson is in advanced talks with BK Modi of Spice Mobiles to acquire his 64% stake in the company. According to ET, Modi demanded Rs 80-100 per share from the world’s 3rd largest mobile handset manufacturing company means Spice Mobile will be valued at around Rs 700 crore. This is a steep valuation for the company but Modi is an expert in getting good bargain (Spice Communications sale).

According to Economic Times, Sony Ericsson is in advanced talks with BK Modi of Spice Mobiles to acquire his 64% stake in the company. According to ET, Modi demanded Rs 80-100 per share from the world’s 3rd largest mobile handset manufacturing company means Spice Mobile will be valued at around Rs 700 crore. This is a steep valuation for the company but Modi is an expert in getting good bargain (Spice Communications sale).If this takeover materialises, it will be a windfall for the shareholders of Spice Mobile. Sony Ericsson is in desperate need to get strong foothold in fastest growing Indian market. Nokia is holding more than 65% market share but Sony has good presence in high end market. If Sony Ericsson acquires Spice Mobile, it will give access to low end market.

In India, major growth is happening in the cheap mobile handset segment. Even though this segment offers low margins but it is high in volumes. Unless one gets a strong foothold in this segment, it is impossible to gain market share in India. Even though Spice Mobile is a late entrant in India, it is ideally positioned to give tough competition to Nokia. Sony Ericsson is buying Spice Mobile to make strong presence in this segment.

Spice Mobile stock price analysis:

CMP: 22.70

P/E: 9

1 year high-low: 36-16.

Spice Mobile target price:

1. If deal fails: This news still act as short term trigger.

2. If deal goes on expected lines: Investors will get more than 300% returns in 2-3 months.

3. If deal will happen on moderate grounds: Investors will get 100-150% returns in 2-3 months.

Spice Mobile stake holdings:

Promoters: 64%

Public: 14%

Other corporate: 22%

If Sony Ericsson acquires Modi’s 64% stake in Spice Mobile, it will need to make an open offer, according to regulations. Closely follow this scrip. If Sony Ericsson acquires Spice business, it will become the second largest mobile handset company in India.

Somi Conveyor - another poor debut for IPO

Somi Conveyor Beltings settled at Rs 25.90 on BSE, a discount of 26% over the initial public offer price of Rs 35. The stock debuted at Rs 37.65 which was also the high for the day. At the debut price of Rs 37.65, the stock attracted 5% premium over the IPO price.

It hit a low of Rs 24.70. On BSE, 75.87 lakh shares changed hands in the counter.

The current price of Rs 25.90 discounts the company's nine months ended December 2007 annualised EPS of Rs 1.1 by a PE multiple of 23.54.

The fixed price IPO of Somi Conveyor Beltings was subscribed 1.92 times.

The company had entered the capital markets on 24 June 2008 with an issue of 62.27 lakh equity shares of Rs 10 each at a fixed price of Rs 35 (including a premium of Rs 25 per equity share) aggregating to Rs 21.79 crore.

The company is manufacturs rubber conveyor belts of various sizes used for industrial applications of material handling in various industries such as coal, lignite, iron ore, mining, cement, power, steel, fertilizer and sugar and it has also recently introduced food grade belts for tea gardens and salt industries.

The company proposes to utilize the net proceeds of the issue to part finance its Rs 35.09 crore project cost. The expansion and modernization project consists of setting up of new manufacturing unit, purchase of land and building for office use, meeting margin money requirement for enhanced working capital and meet the interest cost during the construction period. The company, earning profits since last 5 years, had commenced production with an initial capacity of 36,000 meters per annum (MPA) and it has expanded to present operating capacity of 1,67,660 MPA. Depending upon the width of the rubber conveyor belt the capacity utilization can be stretched up to 2,00,000 MPA.

The company reported a net profit of Rs 0.96 crore on sales of Rs 10.92 crore in nine months ended December 2007.

Courtesy: capitalmarket.com

Pantaloon retail offers 1:10 bonus share

The new shares called Class B shares will get 5 per cent more dividend than ordinary shares and would be entitled to one vote for every 10 held.

Pantaloon will be among the first companies to offer such a financial instrument in India. Some of the global companies that have issued shares with differential voting rights include Berkshire Hathaway, Google and News Corp.

The record date will be fixed after the necessary approvals are obtained by the company, Pantaloon said in a release.

Explaining the rationale behind the initiative, Pantaloon Managing Director Kishore Biyani said that differential voting rights (DVRs) have become a widely-used innovative instrument in global markets and, by coupling a bonus issue with a DVR, the company is offering another alternative to its shareholders.

"DVRs meet the different requirements of different shareholder groups and, with this issuance, we will be introducing a new financial instrument for the new economy," he said. Enam Securities is the advisor to Pantaloon Retail to this issuance.

Under the Companies Act, a firm that has been profitable for three years and which has no default record in filing annual accounts and returns can issue shares with DVRs.

The issue has to be approved by shareholders and should not exceed 25 per cent of the total share capital issued. Further, family-owned businesses can issue shares with DVRs to members of their family.

Experts said DVRs can arm promoters with a minority holding in their companies with a potent tool to fight hostile takeovers. However, grey areas in Indian laws have dissuaded promoters from using DVRs.

Already, a case involving Karamjit Jaiswal and his company LP Jaiswal & Sons of Jagatjit Industries and his step-brothers Anand Jaiswal and Jagajit Jaiswal has reached before the Company Law Board over the use of DVRs in 2004. LP Jaiswal & Sons subscribed to 2.5 million shares in Jagatjit Industries, increasing its stake to 19.1 per cent from 15 per cent.

However, each of these 2.5 million shares carried 20 voting rights. Karamjit Jaiswal later bought 2.19 million ordinary shares, increasing his stake to 13 per cent from 8.59 per cent.

With this, he and LP Jaiswal together owned a combined 32.1 per cent in Jagatjit Industries. However, because of the DVRs of the shares acquired by LP Jaiswal & Sons, this minority holding translated into voting rights of 62 per cent, giving Karamjit Jaiswal complete control over the company allowing him to fend off a hostile takeover bid from his step-brothers.

Courtesy: business-standard.com

Nu Tek India Limited IPO Information

Incorporated in 1993, Nu Tek India Limited is a Telecom infrastructure service provider, offering Infrastructure rollout solutions for both mobile and fixed telecommunication networks. Nu Tek offer services to Telecommunication Equipment Manufacturers, Telecom operators as well as third party infrastructure leasing companies in installing and maintaining Telecom Network Equipment & Infrastructure.

Incorporated in 1993, Nu Tek India Limited is a Telecom infrastructure service provider, offering Infrastructure rollout solutions for both mobile and fixed telecommunication networks. Nu Tek offer services to Telecommunication Equipment Manufacturers, Telecom operators as well as third party infrastructure leasing companies in installing and maintaining Telecom Network Equipment & Infrastructure.Nu Tek undertake turnkey projects, provide management expertise to their clients for infrastructure creation and installation for telecom sites which includes Passive Infrastructure like Towers, Telecom Shelters, Backup Power - DG sets and Battery Banks, Electrical Infrastructure and Earthing Stations etc. and active infrastructure like Base Transceiver Station (BTS), microwave, optic fibre, Base Station Controller (BSC), Mobile Switching Centres (MSC), IN (Intelligent networks), VAS (Value added services) equipments, transmission equipment such as STM’s and Microwaves to the most advanced World Interoperability for Microwave Access (WIMAX) equipment and future ready 3G Nodes. Company also provide technical support services in the High End Telecom segments such as Radio Frequency and Transmission Planning, Network Tuning & Optimization and Quality of Service (QoS) to their clients.

Major clients amongst Telecom Equipment Manufacturers are:

1. Nokia Siemens Networks Pvt Ltd

2. Ericsson India Pvt Ltd

3. Motorola India Pvt Ltd

4. Nortel Networks India Pvt Ltd

Major clients amongst Telceom Operators are:

1. Tata Teleservices Ltd

2. Reliance Communications Ltd

3. Bharti Airtel Ltd

4. Idea Cellular Ltd

5. Vodafone Essar Ltd(Hutch)

6. Videsh Sanchar Nigam Ltd

Major clients amongst third party infrastructure leasing companies are:

1. Quipo Telecom Infrastructure Ltd

2. Essar TTIL Ltd

3. Xcel Telecom Ltd

4. IMI Ltd

Objects of the Issue:

1. The objects of the Issue are to achieve the benefits of listing on the Stock Exchanges & to raise capital for: Capital Expenditure;

2. Overseas Acquisitions;

3. Augmenting Long Term Working Capital requirement;

4. General Corporate Purposes;

5. Expenses related to Fresh Issue.

Nu Tek India Ltd IPO Information:

»» Public Issue Open: July 29, 2008 to August 01, 2008

»» Public Issue Type: 100% Book Built Issue (Initial Public Offer IPO)

»» Public Issue Size: 4,500,000 Equity Shares of Rs. 10/-

»» Face Value: Rs. 10/-

»» Public Issue Price: Rs 170/- to Rs 192/-

»» Maximum Subscription Amount for Retail Investor: Rs 100,000/-

»» Listing: BSE, NSE

»» Lead Manager: Spa Merchant Bankers Ltd, India Infoline Ltd

»» Registrar: Aarthi Consultants Pvt Ltd (Ph: +91-40-27638111 Email: info@aarthiconsultants.com)

Courtesy: Chittorgarh.com

Sensex nudges 15000 mark and Nifty nudges 4500

At 3 pm, Bombay Stock Exchange's Sensex surged 850 points or 6.04 per cent at 14,955.63. The index rose to high of 14,955.63 from a low of 14,568.22 in trade so far.

National Stock Exchange's Nifty rose 5.59 per cent or 237 points to 4476.95. The index touched a high of 4491.55 and low of 4246.70.

Second rung stocks were in action as well. BSE Midcap and Smallcap indices were up 5.12 per cent and 4.19 per cent respectively.

Biggest Sensex gainers were Reliance Communications (12.57%), BHEL (12.49%), ICICI Bank (12.2%), Reliance Infrastructure (11.72%), HDFC (10.31%) and State Bank of India (9.7%).

Cipla, down 1.28 per cent, was the only loser in the 30-share index.

Market breadth was extremely positive with 2239 advances and 407 declines on BSE. On NSE, there were 1172 advances and 102 declines.

Courtesy: economictimes.indiatimes.com

Sasken Communication rings on strong Q1 results

The company announced the results during trading hours today, 18 July 2008.

Meanwhile, the BSE Sensex was up 519.13 points, or 3.96%, to 13,630.98, helped by a 10% decline in oil prices this week.

On BSE, 11.47 lakh shares were traded in the counter. The scrip had an average daily volume of 8.85 lakh shares in the past one quarter.

The stock hit a high of Rs 142 and a low of Rs 130 so far during the day. The stock had a 52-week high of Rs 493.65 on 20 July 2007 and a 52-week low of Rs 84 on 24 March 2008.

The small-cap company had underperformed the market over the past one month till 17 July 2008, declining 16.23% compared to the Sensex’s decline of 14.98%. It had outperformed the market in the past one quarter, declining 6.56% compared to Sensex’s decline of 20.44%.

The company has an equity capital of Rs 28.56 crore. Face value per share is Rs 10.

The current price of Rs 137.70 discounts its Q4 March 2008 annualised EPS of Rs 9.92, by a PE multiple of 13.88.

Sasken Communication Technology’s total income rose 7.81% to Rs 110.72 crore in Q1 June 2008 over Q4 March 2008.

The company provides telecommunication software services and solutions. The group operates in three segments, software services, software products and network engineering services.

Sensex up over 1000 points in 2 days

As per provisional data, foreign funds bought shares worth a net Rs 408.21 crore and domestic institutional investors sold shares worth a net Rs 70.47 crore today, 18 July 2008.

On the New York Mercantile Exchange, August 2008 crude settled $5.31 lower at $129.29 a barrel yesterday, 17 July 2008.

European markets, which opened after Indian market, were in the red. Asian markets, which opened before Indian market, were mixed.

The wholesale price index (WPI)-based annual rate of inflation rose to 11.91% in the week ended 5 July 2008, marginally higher than the 11.89% rise in the previous week. Inflation for the week ended 10 May 2008 was revised upwards to 8.57% from 7.82% reported earlier. The data was released after market hours yesterday, 17 July 2008.

The 30-share BSE Sensex surged 523.55 points or 3.99% to 13,635.40. It hit a high of 13,684.27 in late trade. At the day's high, the Sensex surged 572.42 points. The Sensex lost 18.51 points at day’s low of 13,093.34 hit in mid-morning trade.

The broader based S&P CNX Nifty advanced 145.05 points or 3.67% to 4,092.25. Nifty July 2008 futures were at 4056.70, at a discount of 35.55 points as compared to spot closing.

Sensex has risen 1059.60 points or 8.42% in last two trading days from its close of 12575.80 on 16 July 2008. Prior to this the BSE Sensex plunged 1350.44 points or 9.67% in four trading sessions from 13964.26 on 9 July 2008 to 12575.80 on 16 July 2008.

Sensex is down 6651.59 points or 32.78% in the calendar year 2008 so far from its close of 20,286.99 on 31 December 2007. It is 7571.37 points or 35.70% away from its all-time high of 21,206.77 struck on 10 January 2008.

Back to today's trade, the market breadth was strong on BSE with 1614 shares advancing as compared to 990 that declined. 83 remained unchanged.

The BSE Mid-Cap index was 1.48% to 5,231.42 and the BSE Small-Cap index rose 1.05% to 6,454.03, as per provisional closing. Both these indices underperformed the Sensex.

Political uncertainty will continue to weigh on the market early next week. The government is holding a two-day special session of parliament on 21 July 2008 and 22 July 2008 to seek vote of confidence after it was reduced to minority following withdrawal of support by Left parties on 8 July 2008. The government hopes to retain power due to backing from Samajwadi Party, a regional party in Uttar Pradesh.

The total turnover on BSE amounted to Rs 5312 crore as compared to Rs 4,865.47 crore on Thursday, 17 July 2008. NSE's futures & options (F&O) segment turnover was Rs 52,794.98 crore, which was higher than Rs 46,300.96 crore on Thursday, 17 July 2008.

Among the 30-member Sensex pack, 22 advanced while the rest slipped.

Shares from banking and financial services providers rallied after the latest data showed inflation rose at a slower pace than expected in the year through 5 July 2008.

India’s largest private sector bank in terms of net profit ICICI Bank vaulted 13.02% to Rs 622.95 on 30.74 lakh shares after the bank’s American depository receipt (ADR) rallied 9.4% to $29.02 on the New York Stock Exchange (NYSE) yesterday, 17 July 2008. It was the top gainer from Sensex pack.

HDFC Bank (up 7.54% to Rs 1030.35), and State Bank of India (up 5.37% to Rs 1293), surged.

India's largest dedicated housing finance company in terms of operating income HDFC soared 10.13% to Rs 2080. The stock rallied 9.91% yesterday, 17 July 2008 after the company's chairman Deepak Parekh denied rumors that Citigroup may sell its 11.74% stake in firm.

India’s largest private sector firm by market capitalization and oil refiner Reliance Industries advanced 4.69% at Rs 2110 on 14.12 lakh shares. The stock moved in a range of Rs 2125 and Rs 1995.05 in the day.

Reliance Communications, the country’s second largest cellular services provider in terms of market capitalisation was up 3.61% to Rs 433.

Mukesh Ambani-owned Reliance Industries (RIL) on Thursday, 17 July 2008 said it has started arbitration proceedings against younger brother Anil Ambani’s Reliance Communications (RCOM) to thwart the latter’s merger with Africa’s largest telco MTN. According to reports, RCom has dismissed the RIL move and said the arbitration can only happen when both parties refer the dispute to a person outside the court. RCom's talks with MTN, which have been extended once, are scheduled to end on 21 July 2008.

Two oil exploration heavyweights saw edged higher. Oil & Natural Gas Corporation (ONGC) gained 3.68% to Rs 937 while Cairn India rose 0.72% to Rs 218

Bharti Airtel (up 7.50% to Rs 805), and Jaiprakash Associates (up 8.86% to Rs 162.25), gained from the Sensex pack.

DLF (up 6.65% at Rs 455.55), Unitech (up 3.72% to Rs 147.90), Ansal Infrastructures (up 8.27% to Rs 93.95), Parsvnath Developers (up 1.70% to Rs 110), and Indiabulls Real Estate (up 6.54% to Rs 287.35), surged from the real estate space.

Most IT pivotals declined after India’s third largest software services exporter Wipro said it was cautious in the near term, echoing its larger rivals TCS and Infosys.

Wipro slumped 4.23% to Rs 363.75. The company posted 3.16% rise in consolidated net profit to Rs 907.8 crore on 5.18% rise in total income to Rs 6087.1 crore in Q1 June 2008 over Q4 March 2007. The company announced the results before trading hours today, 18 July 2008.

India’s fourth largest software services exporter Satyam Computer Services plunged 7.53% to Rs 383 on 45.77 lakh shares. It was the top loser from Sensex pack. The company reported 17.32% rise in consolidated net profit to Rs 547.70 crore on 8.47% increase in consolidated sales to Rs 2620.83 crore in Q1 June 2008 over Q4 March 2008. The company declared the results before market hours today, 18 July 2008.

India’s second largest software services exporter Infosys was down 1.76% to Rs 1555.

However India’s largest software services exporter TCS staged a strong recovery from day’s low of Rs 748.60. It rose 1.54% to Rs 791.20

Ranbaxy (down 3.72% to Rs 435.40), and ACC (down 1.06% to Rs 533.10), edged lower from Sensex pack.

Metal stocks slipped on selling pressure. Tata Steel (down 3.38% to Rs 586.90), Sterlite Industries (down 3.02% to Rs 590), JSW Steel (down 2.23% to Rs 725), Sesa Goa (down 1.74% to Rs 2708.85), and Hindustan Zinc (down 1.02% to Rs 526), declined from metal sector.

Reliance Capital topped the turnover chart on BSE with a turnover of Rs 323.70 crore followed by Reliance Industries (Rs 291.50 crore), Reliance Petroleum (Rs 193 crore), ICICI Bank (Rs 185 crore) and Satyam Computer Services (Rs 177.70 crore).

Reliance Natural Resources led the volume chart with volumes of 1.67 crore shares followed by IFCI (1.45 crore shares), Reliance Petroleum (1.28 crore shares), IDFC (1.05 crore shares) and Chambal Fertilisers (90.25 lakh shares).

Fertiliser shares rallied. Coramandel Fertilisers (up 4.41% to Rs 119.65), Nagarjuna Fertilizers & Chemicals (up 2.68% at Rs 30.60), Gujarat State Fertilizers & Chemicals (up 1.18% at Rs 145.80), Chambal Fertilisers & Chemicals (up 4.98% at Rs 60.05), Rashtriya Chemicals and Fertilizers (up 1.76% at Rs 49.05), soared

State run oil-marketing companies extended gains for the third straight day today, 18 July 2008, tracking sharp fall in crude oil prices for the third straight day yesterday, 17 July 2008. Hindustan Petroleum Corporation (up 4.36% to Rs 218), Bharat Petroleum Corporation (up 3.11% to Rs 283.25), and Indian Oil Corporation (up 5.06% to Rs 382), surged.

Kirloskar Brothers slumped 10.42% to Rs 166 on reporting a net loss of Rs 4.48 crore in Q1 June 2008 as against net profit of Rs 25.71 crore in Q1 June 2007. The company announced the results during trading hours today, 18 July 2008.

Ballarpur Industries soared 6.35% to Rs 31 on reports cigarette maker ITC bought over 23 lakh shares or 0.5% of the equity of the company for Rs 5.60 crore in the last couple of months. The move has created a stir in corporate circles as ITC has major interests in paper through ITC Bhadrachalam Paperboard.

Gujarat NRE Coke jumped 8.79% to Rs 113.30 after posting 120.46% surge in net profit to Rs 94.4 crore on 150.77% increase in total income to Rs 382.12 crore in Q1 June 2008 over Q1 June 2007. At the time announcing Q1 June 2008 results today, 18 July 2008, he company’s board has also announced issue of bonus shares in the ratio of 2:5.

Infrastructure Development Finance Company soared 14.58% to Rs 108 after the company reported 22% jump in net profit to Rs 204.73 crore on a 45.42% rise in revenue to Rs 809.71 crore in Q1 June 2008 over Q1 June 2007.

Finance Ministry P Chidambaram yesterday, 17 July 2008 said more measures might be taken to tame prices even as the steps taken by the Reserve Bank of India (RBI) take effect. Inflation is hovering at a 13-year high and is well above the RBI’s tolerance level of 5.5% set for the current fiscal.

The RBI is scheduled to review monetary policy on 29 July 2008 and analysts opine that the central bank may tighten monetary policy again. Last month, the RBI increased its key lending rate by 75 basis points and hiked the banks' reserve requirements by 50 basis points to combat inflation.

European markets, which opened after Indian markets were in the red. Key benchmark indices in UK, Germany and France were down by between 0.22% and 0.90%.

Asian markets which opened before Indian markets were trading mixed today, 18 July 2008. Key benchmark in Taiwan, South Korea, Singapore and Japan, and were down by between 0.65% and 2.28%. However indices from China and Hong Kong gained 3.49% and 0.64% respectively.

US stocks rallied building on optimism spurred by several unexpectedly strong earnings reports, including JPMorgan Chase. The Dow Jones Industrial Average surged 207.38 points, or 1.85%, to 11,446.66. The Standard & Poor's 500 index rose 14.96 points, or 1.20%, to 1,260.32, and the Nasdaq Composite index gained 27.45 points, or 1.20%, to 2,312.30.

RCom, MTN call off talks for deal

In a surprise development, Reliance Communication Ltd (RCom) said on Friday evening that the company and the South African telecom major MTN Group have mutually decided to call off their talks for a business deal.

In a release issued by the company said “owing to certain legal and regulatory issues, the parties are presently unable to conclude a transaction. Accordingly, it has been mutually decided to allow the Exclusivity Agreement to lapse”.

Both RCom and MTN had entered into a 45-day exclusive negotiations for the proposed merger of their business. The deadline for the talks, which was on July 9, was extended to July 21.

However, before the end of the deadline, the parties have mutually decided to call off the talks.

According to sources, there could be reasons except “legal and regulatory issues, which have forced RCom, headed by Mr Anil Ambani, to end the talks. RIL headed by his estranged brother, Mr Mukesh Ambani, has been opposing the deal and initiated arbitration proceedings against RCom.

Yesterday, RIL said it had commenced arbitartion proceedings and has nominated Mr Justice B.P. Jeevan Reddy, a former Supreme Court judge.

Helping rag-pickers to become entrepreneurs

The bank has issued ‘laghu udyami’ credit cards to 25 women members of the rag-picking community.

The bank initiated the process of bringing rag-pickers under the banking network by forming five self-help groups (SHGs) of rag-pickers in Dharwad in June 2007. In September that year, the bank went ahead with credit-linking the five SHGs .

Mr M. Dhananjaya, Chairman, told Business Line that the SHGs, which were given loans, have started repaying the loans and now some of the members of the group have started depositing the amount in the bank.

Credit cardsAfter observing the banking habits of rag-pickers for a year, the bank decided to develop entrepreneurship skills among the womenfolk and came up with the idea of extending ‘laghu udyami’ credit cards to them.

Mr Ullas Gunaga, who was actively involved in the formation of the SHGs, said that five groups were sanctioned loans to the tune of around Rs 5.25 lakh. The loans were closed before term, denoting their sincerity and promptness in credit dealings.

Added to this, five members of these SHGs have deposited Rs 10,000 each in the savings bank account of the bank. Members of these SHGs are illiterate and migrants from northern India.

Asked about the reasons for extending ‘laghu udyami’ credit cards to them, he said this will help them bypass middlemen in their work. Added to this, some women members have started persuading their husbands to start work using the items they collect while picking rags.

Maintaining accountDuring the coming days, the bank plans to expose them to issues such as health, hygiene, and education, Mr Dhananjaya said. To a query on how these members maintain their accounts, he said that a social worker from the area, Ms Geeta Patil, is maintaining accounts for them.

Britannia to explore new international markets

“We are also looking at ghee very seriously, and exploring the possibilities of exporting it to West Asia and Far East countries,” said Mr T. N. Nandakumar, Regional Manager – International business. The new markets being evaluated for the export of ghee are the UAE, Singapore and Malaysia amongst others.

With the Indian diaspora already hooked onto its products, Britannia, which sells in the US, Canada and Southern Africa, is looking to tweak tastes and portfolio for other American citizens. It will be launching a new cream biscuit, “the Oreo kind”, and pushing its digestive range, cream crackers, and Nutrichoice, which has been doing well in the international markets and is preferred by a more health-conscious consumer. “We already have the Indian diaspora taken care of, now we are looking at the average American consumer, and other communities with different palettes. We would like to be in certain States, that we are identifying, which we believe are more stable for our business,” he said.

It already exports to Malaysia and Singapore. The West Asian and central Asian markets of Jordan, Yemen and Iran are being catered to by the companies in which it acquired a majority stake last year — the Dubai-based Strategic Foods International LLC and the Oman-based Al Sallan Food Industries, through its association with the Khimji Ramdas Group.

It also plans to target East Africa and Madagascar through its own Indian operations. Mr Nandakumar said that prices for Britannia’s products had been raised in markets abroad too, but the rising costs issue was something that consumers understood.

Foster Wheeler in talks with BGR Energy for boiler manufacture

The talks are still open as to whether the collaboration will be a joint venture or a technology transfer. At a recent press conference, the Chairman and Managing Director of BGR Energy, Mr B.G. Raghupathy, said that the company was in talks with a large multinational company for collaboration for producing power boilers.

While he did not mention Foster Wheeler, he said that the MNC had supplied the boiler for a 460-MW project in Poland, of the ‘circulating fluidised bed combustion (CFBC)’ type. Foster Wheeler fits the description.

Foster Wheeler has supplied the boiler for the 460 MW Lagisza project in Poland — the biggest CFBC boiler ever to be supplied in the world.

(Incidentally, it is also the only one in the world which is a CFBC and supercritical — combining the advantages of both the technologies.)

Later, sources in BGR Energy confirmed to Business Line that the prospective collaborator is indeed Foster Wheeler.

They, however, said that a lot of negotiations are yet to be covered before a partnership agreement is signed.

Foster Wheeler, which has supplied equipment for over 1,10,000 MW of capacity across continents, has a back office in India for design work.

It was to have supplied equipment to the 1,000 MW lignite-based Jayamkondan project in Tamil Nadu, when Reliance bagged the contract for that project.Foster Wheeler’s expertise is in CFBC technology. CFBC boilers can burn any type of fuel — such as a combination of imported and indigenous coals, lignite and refinery residue.

Demand in India for CFBC boilers are expected to grow mainly because of this flexibility.

For example, Neyveli Lignite Corporation is putting up two units of 250 MW using CFBC boilers. Coastal Energen of the Dubai-based ETA group is planning to put up four units of 350 MW each, again with CFBC boilers.

Foster Wheeler has supplied over 300 CFBC boilers globally. The shortage of power equipment manufacturing capacity in India has attracted many domestic and international players to set up facilities.

L&T-Mitsubishi Electric, Cethar Vessels with technology from Riley Power of the US, and the joint venture of NTPC and BHEL are some examples.

BGR Energy, an engineering company that specialises in supplying ‘balance of plant (BoP)’ for power projects, has been saying for some time that it would get into the manufacture of boilers and turbines also.

No TDS certificates for returns

Mukesh Ambani meets PM, decries demands for windfall tax

With UPA government’s new found ally Samajwadi Party gunning for Reliance Industries, the company head Mukesh Ambani on Monday met Prime Minister Manmohan Singh and a host of other senior government functionaries to explain how demands for levy of windfall tax was bad economics.

Ambani first met Singh and there were unsubstantiated reports that he followed this with a meeting with Congress President and UPA Chairperson Sonia Gandhi.

Flying in from Mumbai this morning, Mukesh started a series of meeting with top bureaucrats, including a call to Cabinet Secretary K M Chandrasekhar.

Ambani’s visit assumes importance in the wake of Amar Singh raising a number of issues, including a demand for withdrawal of EOU status for RIL’s Jamnagar refinery along with a suggestion that Prime Minister should intervene to bring peace between Mukesh and younger brother Anil.

Sources said Ambani pleaded that the demand for levy of so-called windfall profit tax on private firms was no more than a populist slogan based on the misleading logic that with rising prices of oil across the globe, these companies are making profits far in excess of what they legitimately deserve.

While Government shares production from oil and gas fields and is a beneficiary of high oil prices, the refinery business is highly cyclical and with new capacities coming on stream world over margins will decline precipitously.

Ambani is believed to have told policy makers that fiscal revenue gain from a WPT would be short-term in nature, but the economic costs of introducing an unstable fiscal regime could be long lasting.

Ambani is believed to have told policy makers that during boom periods of business cycles diverse sectors enjoy high returns like the IT boom in the late 1990s, but a WPT was not even contemplated for them.

Presently, many domestic natural resource-extracting entities in non-oil sectors have also benefited financially from the unprecedented global commodity boom. Will it be justified to impose WPT on them, he asked.

The US imposed a WPT in 1980 but repealed it in 1988 as it led to increased dependence on imported oil and gross revenue gains were significantly less than anticipated.

Ambani is believed to have stated that the current high crude oil price has led to an unprecedented increase in supply and service costs raising both exploration and development of oil and gas by a factor of 3 times over the last 3-4 years.

In economic terms, taxes such as WPT increase marginal production costs, and profit maximising firms respond to it by reducing output and raising prices.

Imposing WPT could have several adverse economic affects. If imposed as an excise tax, the WPT would increase marginal production costs, reduce domestic oil production and increase the level of oil imports.

Windfall profit tax is a tax on actual profit or profit margins. If levied on actual profit then it would need to take into account the capital invested, asset base and similar parameters while if levied on profit margins it was necessary to look at margins of other businesses especially during boom periods.

Refining business, Ambani is believed to have argued, is cyclical in nature. Product deficits catalyses expansion plans. But as new capacities come on stream, refining margins decline precipitously. Also, refining needs large and continuous investments just to meet stringent clean fuel specifications and stay in business.

Usha Mittal, Tina Ambani in Forbes list

They are married to the wealthiest individuals in the world but a few of them have etched out their own identity, with two Indians-Usha Mittal and Tina Ambani making a cut in the latest ’Wives of Billionaires’ list compiled by US business magazine Forbes.

Usha Mittal is the wife of world’s fourth richest person and steel tycoon Lakshmi Mittal while Tina Ambani is married to sixth wealthiest person Anil Ambani, whose flagship firm Reliance Communications. In an article on its website, Forbes said that "gaining membership to the billionaire wives’ club is no easy feat... so what does it take to marry one... For starters, looks are great-but brains are even better."

Prior to marrying Anil Ambani, Tina Munim was a famed Bollywood actress, it noted. Usha Mittal also has worked in the steel business for 15 years, one time running a plant in Indonesia Forbes said.

Inflation to touch 17% by September: Barclays

Global investment banker Barclays Capital has projected that inflation may surge to 17 per cent by September on back of another round of hike in fuel prices in the same month.

"We believe WPI inflation will remain in double-digit territory until May 2009. We expect WPI inflation of 17 per cent by September 2008," the report said.

For the week-ended June 28, wholesale prices-based inflation touched a new 13-year high of 11.89 per cent much higher than the Reserve Bank’s tolerance limit of 5.5 per cent for the current fiscal.

According to the report, the government is likely to hike fuel prices between 10 and 20 per cent again as early as September to limit fiscal risks.

Rise in the price of the Indian crude oil basket to $145-150 per barrel from the current $132 per barrel could be the trigger for another round of increase in fuel prices, it said.

The government last revised retail petroleum prices with effect from June 5, when petrol prices was increased by Rs 5 a litre, diesel by Rs 3 per litre and cooking gas by Rs 50 per cylinder.

This resulted in inflation touching a double digit figure of 11.05 per cent for the week ended June 7.

Last week, even Finance Minister P Chidambaram’s adviser Shubhashis Gangopadhyay predicted that double digit inflation will continue throughout the year 2008 and could impact the economic growth negatively.

Barclays Capital said, "we believe the momentum in core inflation will pick up steam in the next two quarters".

Over the next two quarters, manufacturing sector inflation would add to 200-300 basis points to the headline WPI rate, food and oilseed inflation would add 100-200 basis points, and energy inflation a further 100-150 basis points, it said.

The second-round effects of recent commodity price shocks are already passing through, and this process is expected to accelerate, it added.

RBI is also expected to further tighten monetary policy by hiking short term lending rate (repo rate) and mandatory cash requirements for banks to tame inflation.

The two monetary policy tools the RBI would utilise to rein in inflation would be the CRR and repo rate, it said.

"We forecast repo rate hikes of 200-250 basis points by end-2008, versus our earlier outlook for 150-200 basis points, from the current 8.5 per cent," it said.

In addition, the CRR which is currently at 8.75 per cent would be increased by 125-175 basis points by the year-end, it added.

The investment banker also revised average WPI forecast for the current year to 14 per cent from the earlier estimate of 13 per cent.

PM, govt top guns may broker Ambani peace deal

When it comes to getting the prime minister to intervene in a corporate battle, there is no better name than Ambani to do it. The stakes are rising for Mukesh and Anil Ambani, among the top 10 richest men in the world, and sensing the dangers of getting caught up in the corporate battlefield, the government is expected to intervene at the top level to work out a truce between the two feuding brothers.

The decision to step in comes on the backdrop of the two brothers taking their recently renewed rivalry over the MTN deal to a new level — national politics.

The development, which coincides with the new power play in the Capital, is symbolic of the government’s anxiety to insulate itself from the consequences of the fratricidal corporate war. There is acknowledgement in the government that a truce, at least a temporary one, was possible only if the top two of the ruling arrangement — Prime Minister Manmohan Singh or Sonia Gandhi — prepare the groundwork for negotiations between the two brothers.

The prime minister, who has been discussing the charges and counter-charges levelled by the two sides with oil minister Murli Deora during the past one week, is conscious that the minister does not have the wherewithal to bring about a truce. Anil feels the oil minister is closer to big brother Mukesh, while Mukesh is said to be wary of finance minister P Chidambaram’s alleged proximity to his younger brother. Both are, thus, effectively ruled out as negotiators.

The nitty-gritty can be worked out by leaders like SP’s Amar Singh and Congress president’s political secretary Ahmed Patel. But it can only happen after the big two enter the frame,” said a leader familiar with the patch-up efforts. He was confident that the issue will remain on the “must do” list of the prime minister till the two brothers reach the negotiating table. South Block is learnt to have already broached the issue with the brothers.

The government’s jitters over the on-going feud is understandable. Ever since Amar Singh proved that impossible is nothing by negotiating a deal with the Congress with whom his SP was daggers drawn, there have been whispers that the entry of the SP, with whom Anil has close relations, would trigger the escalation of the six-year-old feud within the family.

The rumours gathered momentum as the day after the SP announced its support to the UPA, Mukesh was served with a show-cause notice by the Customs department for under-invoicing the purchase of an Airbus, which he had bought as a gift for his wife Nita on her birthday last year. The impression of the government, getting mired in the sibling warfare, got credence when Amar Singh placed his charter of demands that looked inimical to Mukesh’s interests. Amar Singh refutes charges that he is acting at the behest of his friend, the younger Ambani, saying “my closeness with Anil does not prevent me from taking up matters of public interest.”

Anil Ambani, who was in the Capital earlier this week, had met external affairs minister Pranab Mukherjee on Tuesday. The meeting, sources claimed, was to brief him about his side of the MTN story.